Planning a car maintenance budget helps you prepare for unexpected repair expenses

If you don’t plan for these costs, they can sneak up on you and cause stress.

By saving money for your car’s needs, you can avoid surprises and keep your car in good shape.

This post is a definitive guide to budgeting for car repairs and maintenance.

Contents

Looking to save on your car maintenance budget? We’ve packed this guide with everything you need to keep your car running smoothly without breaking the bank! Use our table of contents below to jump straight to the tips and strategies that matter most to you. Dive in, plan smart, and drive worry-free!

- Understanding Costs

- Tips to Reduce Costs

- How Much for Routine Maintenance

- How Much for Unexpected Repair

- How to Pay for Repairs & Maintenance

- Consider an Extended Warranty

- Using a Sinking Fund

- Hidden Costs of Repair & Maintenance

- What if You Don’t Have Money

- Maximizing Your Car’s Value

Understanding Auto Repair

and Maintenance Costs

Car repairs and maintenance can be expensive.

Routine services like oil changes and tire rotations add up over time. Plus, unexpected repairs can happen when you least expect them.

This section covers the essential costs associated with car repairs and maintenance

Common Costs for Repairs and Maintenance

Car repair and maintenance costs can vary for a few reasons.

The type of vehicle, the repair needed, labor rates, and location all play a role.

Simple repairs like oil changes or brake pad replacements are usually affordable.

Complex repairs, like engine work, can cost a lot more than regular maintenance. That’s why it’s important to keep up with your car maintenance budget and understand the best times to service your car.

Staying on schedule helps avoid surprise costs. Check out our guide on understanding your car’s maintenance schedule for more information.

Here’s a breakdown of some common expenses:

Common Car Maintenance Costs

| Maintenance Service | Cost Range (USD) |

|---|---|

| Oil Change | $35 – $150 |

| Brake Pad Replacement | $100 – $300 |

| Tire Rotation | $20 – $60 |

| Wheel Alignment | $75 – $150 |

| Air Filter Replacement | $20 – $40 |

| Battery Replacement | $70 – $200 |

| Coolant Flush | $100 – $150 |

| Transmission Fluid Change | $100 – $250 |

| Spark Plug Replacement | $150 – $300 |

| Timing Belt Replacement | $800 – $1,600 |

| Brake Fluid Flush | $80 – $150 |

How We Came up with these costs?

We researched and compared the average costs for the maintenance tasks listed in the table.

We also used estimates from RepairPal to help come up with accurate values.

While the numbers give a general idea, prices can change based on where you live, the type of car, and the repair shop.

By understanding these costs, you can plan your car maintenance budget more effectively.

How Location Affects Costs

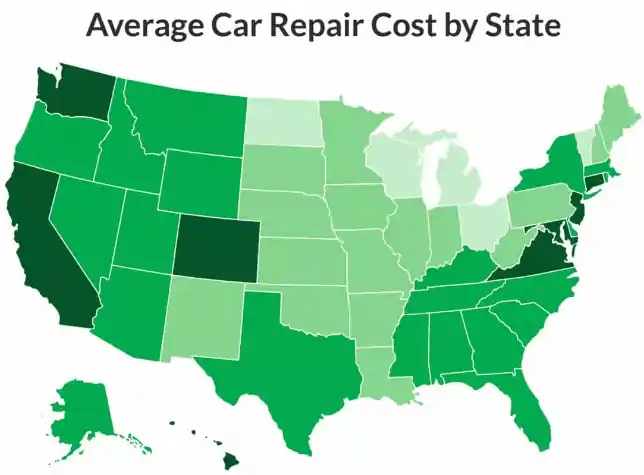

Where you live can affect how much you pay for car repairs and maintenance. In bigger cities or places with a high cost of living, prices for parts and labor are often higher.

For example, a brake job in a big city might cost $500, but in city like Broken Arrow, OK, a brake repair could be closer to $300.

MarketWatch as created a post called 10 States With the Highest Auto Repair Costs with great infographic that show the states with the highest repair costs. They calculated scores for the average cost of a check engine light repair, the median household income and the average mechanic salary in each state.

Costs for Different Types of Vehicles

The type of car you drive affects your car maintenance budget—some cars cost more to repair and maintain than others:

Sedans: These cars are usually cheaper to maintain. Oil changes, tires, and brakes are often less expensive than for larger vehicles.

SUVs: SUVs can cost more to maintain because they have bigger tires and heavier parts. For example, a tire for an SUV might cost $200, while a sedan’s tire could be $100.

Trucks: Trucks are often the most expensive to maintain. They might need more frequent oil changes, and parts like brakes and tires are usually bigger and more costly.

CarEdge Maintenance Insights: Discover Costs by Make & Model

Understanding your vehicle’s future maintenance costs can make a big difference in managing your car maintenance budget effectively. CarEdge provides a powerful tool that lets you dive into the real costs of keeping your car in peak condition, helping you plan and budget with confidence.

By simply entering your car’s make, model, and expected annual mileage, you’ll get access to detailed statistics, including:

- Average Annual Maintenance Costs: See a breakdown of how much you’re likely to spend each year on repairs and maintenance, based on your specific vehicle model.

- Cost Increases Over Time: Cars tend to require more care as they age. CarEdge’s tool highlights how these costs change as the years go by, helping you anticipate future expenses.

- Full Maintenance Schedule: Access a complete maintenance schedule for your car, so you’ll know exactly when to service crucial components like brakes, tires, and fluids.

This valuable insight empowers you to plan ahead, stay on top of maintenance, and avoid unexpected repair costs. Check out CarEdge’s tool today to start budgeting smarter and keeping your car running smoothly!

By knowing what to expect, you can better prepare for the costs of keeping your car in good shape.

Tips to Save on Your

Car Maintenance Budget

for Repairs and Maintenance

This section provides practical tips to help you reduce the costs of car repairs and maintenance.

These strategies can save you money and keep your car in good condition.

You will learn:

- Why Preventive Maintenance Matters

- How to Save with Easy DIY Repairs

- Save Big by Price Shopping

- Why Quality Parts Save You Money

- Why Regular Vehicle Inspections are Important

Stay Ahead of Repairs With Regular Maintenance

Let’s face it—nobody likes spending a lot on car repairs. But here’s the thing: sticking to a car maintenance budget and handling small repairs now can save you a ton later. Think of it like going to the dentist; skipping regular checkups might lead to a costly root canal down the road. The same goes for your car!

How Skipping Basic Maintenance Can Lead to Major Costs

Take oil changes, for example. It’s a simple, inexpensive service, but skipping it can lead to major engine damage. And trust me, fixing or replacing an engine is no small expense.

Then there’s brake maintenance. If you don’t get your brake pads replaced when they’re worn out, you could end up needing new rotors too. That’s easily hundreds of dollars more.

Even something as basic as a tire rotation can prevent uneven wear on your tires, saving you from having to replace them prematurely. Plus, regularly maintaining your tires can help with things like fuel efficiency, which means more money in your pocket over time.

Regular maintenance goes beyond just mechanical care; it includes keeping your car clean and presentable. For insights on how car washes and detailing can enhance your vehicle’s appearance and longevity, check out our guide on the benefits of regular car washes and detailing.

The point is, regular maintenance isn’t just about keeping your car running smoothly—it’s about preventing big problems before they happen. A few dollars spent today could save you from a massive repair bill tomorrow.

Save Money By Doing Basic Car Maintenance Yourself

You don’t need to be a mechanic to handle some basic maintenance on your car, and the best part? It can save you money in your car maintenance budget. We’re talking simple tasks like changing your oil, checking tire pressure, and replacing wiper blades—things you can do yourself without spending a lot.

Essential Maintenance Tasks You Can Handle Yourself

For example, take an oil change. It might cost you $40-$75 at a shop, but if you do it yourself, you’ll only pay for the oil and filter, which usually runs about $20-$30. Not a huge savings per oil change, but over time, it adds up. Plus, you get the satisfaction of knowing it was done right.

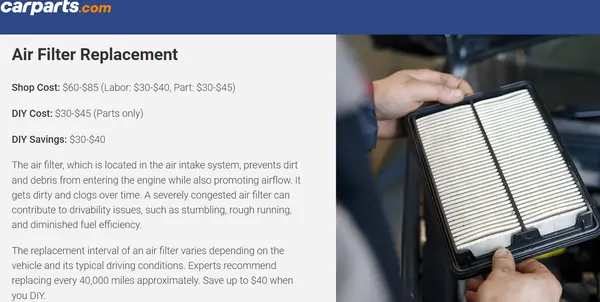

Another easy win is replacing your air filter. The filter itself costs around $20, and you don’t need any tools or special skills to change it. It takes all of 10 minutes and can improve your fuel efficiency—saving you even more money in the long run.

Then there’s the simple task of checking your tire pressure. Keeping your tires properly inflated improves your gas mileage and prevents uneven wear, which means you won’t have to replace your tires as often. Most gas stations have air pumps, or you can buy a cheap tire gauge and portable air compressor to do it at home.

Maintaining proper tire pressure is crucial for safety and fuel efficiency, which is why understanding your Tire Pressure Monitoring System (TPMS) is essential. Learn more about this important feature in our guide on understanding tire pressure monitoring systems (TPMS).

Even replacing wiper blades can save you a trip to the shop. You can grab a pair for around $20, and swapping them out takes maybe 5 minutes. Why pay someone else to do something so quick and easy?

The point is, these basic maintenance tasks are easy to learn, require minimal tools, and save you money by cutting down on trips to the shop. Plus, when you handle these small jobs yourself, you’re less likely to neglect them, which helps prevent bigger (and more expensive) problems down the road.

To get started, check out our guide on essential tools every car owner should have to ensure you’re equipped for these tasks.

So, next time your car needs some basic TLC, why not give it a shot yourself? You might be surprised how much you can save!

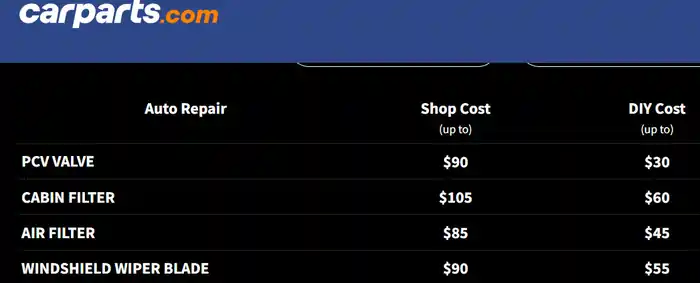

Carparts.com Shows You 15 Easy DIY Car Repairs!

Changing your air filter at home might cost $10 to $20.

Want to save money and time on car repairs?

Check out these easy DIY fixes on carparts.com that can help you maintain your vehicle and avoid costly trips to the shop!

They have really cool list of DIY repairs along with easy instructions.

Get Several Estimates

When your car needs repairs, getting multiple estimates can help keep your car maintenance budget on track. Here’s how to do it effectively!

Research Local Shops

Start by searching for reputable repair shops in your area. Read online reviews and ask friends or family for recommendations. Finding a trustworthy mechanic is the first step to saving money.

Call for Estimates

Once you have a list of potential shops, give them a call. Describe your car’s issue and ask for a ballpark estimate. Many shops, like ours, even offer text messaging for easy communication—so you can get estimates quickly!

Request Written Estimates

Always ask for a written estimate. This helps ensure that you have a clear understanding of the costs involved and protects you from any surprise charges later on. A written estimate should outline parts, labor, and any additional fees.

Compare Services

When you receive estimates, take a closer look at what each one includes. A lower price might sound appealing, but make sure it covers quality parts and thorough service. Some shops may quote low prices but cut corners.

Trust Your Instincts

If one estimate seems suspiciously low or a mechanic isn’t forthcoming with information, trust your gut. Finding a reliable shop that balances quality and cost is essential for saving money in the long run.

By gathering several written estimates, you’re setting yourself up for smarter, more cost-effective car repairs.

Use High-Quality Parts: Cheap Isn’t Always Better

When it comes to car parts, going cheap might seem like a smart move, but it can actually cost you more in the long run. Cheap parts wear out fast, meaning you’ll be back in the shop sooner than you think. Nobody wants to deal with unexpected repairs, right?

Investing in high-quality parts is a game changer. They not only last longer but also keep your car running smoothly. Think about it: with quality parts, you’re less likely to face those annoying breakdowns or performance issues that pop up with low-grade options.

We always recommend going for OEM (Original Equipment Manufacturer) parts or even better alternatives. Sure, they might have a higher upfront cost, but they’re built to last and will save you money over time. Plus, your car will thank you with better performance and reliability.

So, next time you’re tempted by a bargain, remember: saving a few bucks now might mean spending more later. Quality parts are the ultimate investment in your ride’s longevity and your peace of mind!

Regular Inspections: Catch Problems Early

Regular vehicle inspections are like a health check-up for your car—they help you catch issues before they become a big headache (and an expensive one, too!). When you bring your ride in for routine check-ups, our skilled technicians can spot problems like worn-out brakes or if a brake flush is needed..

This proactive approach not only saves money but also keeps your car running smoothly and safely. By tackling small issues early, you help protect your car maintenance budget from bigger, costly repairs down the road. After all, who wants to be stranded over something a quick inspection could have fixed?

So, make it a habit to schedule those regular check-ups. Your wallet will thank you later, and you’ll enjoy peace of mind knowing your car is in great shape. After all, a little maintenance goes a long way in keeping your vehicle happy and healthy!

How Much to Include in

Your Car Maintenance Budget for Routine Maintenance

This section helps you understand how much to budget for routine car maintenance.

It breaks down the average costs of common services like oil changes, tire rotations, and brake pad replacements.

The section also discusses the importance of seasonal maintenance, creating a maintenance calendar, and saving a little each month to cover these expenses.

Common Costs for Routine Maintenance

Keeping your car in good shape requires regular maintenance. It’s important to know how much these tasks will cost so you can plan ahead. Here are some common costs:

Oil Changes: An oil change usually costs between $30 and $100. Synthetic oil is more expensive but lasts longer.

Tire Rotations: Rotating your tires helps them wear evenly. This service typically costs $20 to $50.

Brake Pads: Replacing brake pads costs between $150 and $300 per axle. It’s important to change them before they wear out completely.

Battery Replacement: A new car battery usually costs between $100 and $200.

Knowing these average costs helps you set aside money for your car’s maintenance.

Prepare Your Car Maintenance Budget for Seasonal Needs

Your car needs different care depending on the season. For example, before winter, check your tires, battery, and antifreeze. Preparing for cold weather can prevent issues like a dead battery or slipping on icy roads. Planning a car maintenance budget for these checks—typically between $50 and $200—helps keep your car safe year-round.

Read More: How to Ready Your Car for Exciting Summer Road Trips

Creating a Maintenance Calendar: Stay Organized

Planning ahead makes it easier to keep up with maintenance. You can create a calendar to remind you when it’s time for oil changes, tire rotations, and brake checks. Mark these dates on your calendar or set reminders on your phone. Spreading out the costs over time makes it easier to manage your budget.

Save for Maintenance: Be Prepared

Saving a little money each month for your car maintenance budget is a smart move. Even setting aside $20 or $30 monthly can add up over time. When it’s time for an oil change or new tires, you’ll have the funds ready. This helps you avoid putting these costs on a credit card or dipping into money meant for other important expenses.

How Much to Budget for Unexpected Car Repairs

This section focuses on how to budget for unexpected car repairs.

It suggests setting up an emergency fund, explains the pros and cons of extended warranties, and provides estimates for common repair costs.

The section also highlights the importance of knowing potential repair trends for your vehicle and shares real-life examples of how others handled unexpected repairs.

Set Up an Emergency Car Maintenance Budget for Repairs

Unexpected car repairs can be costly and stressful.

Setting up an emergency fund just for car repairs is a smart way to prepare for these expenses. Even setting aside a small amount each month can add up over time.

For example, you could aim to save $500 to $1,000 in your fund. This money can cover things like a sudden brake repair or a new alternator. Having this fund means you won’t have to rely on credit cards or loans when your car needs unexpected repairs.

Additionally, it’s wise to be prepared for any situation on the road; consider including essential items in your car’s emergency kit. Learn more about what to include in our guide on essential items for your car’s emergency kit.

Are Extended Warranties Worth It?

Extended warranties can help cover the cost of big repairs, but they also cost money upfront.

Before buying an extended warranty, consider your car’s age, mileage, and how long you plan to keep it. If it’s new or has low miles, you might not need extra coverage. But for an older car or one you’ll keep for years, an extended warranty can help protect your car maintenance budget from big repair costs like engine or transmission work.

It’s important to read the fine print and understand what the warranty covers. Learn more in our guide on what engine repair includes.

Estimate Repair Costs: What to Expect

Knowing what common repairs cost can help you budget better. Here are some examples:

Brake Repair: A brake job might cost between $300 and $800, depending on what needs to be done.

Transmission Repair: Fixing or replacing a transmission can cost $1,000 to $3,000 or more.

Engine Repairs: Minor engine repairs might cost $200 to $500, while major repairs could be over $1,000.

By having a general idea of repair costs, you can plan your budget and avoid surprises.

Watch for Repair Trends

Certain car makes and models are known for specific issues. For example, some cars might have problems with their transmissions, while others might need frequent brake repairs.

If you know what issues your car might face, you can plan ahead. Researching repair trends for your car can help you understand what repairs might be needed in the future and how much they could cost.

How to Pay for Car Repairs and Maintenance

This section explores smart ways to fund your car maintenance budget.

It covers paying with cash, using 0% APR credit cards, or getting a loan from a local bank.

It also warns against high-interest loans, suggests using savings for insurance deductibles, and talks about the importance of saving money each month for future repairs.

Different Ways to Pay

When you need to pay for car repairs, you have a few options:

Cash: Paying with cash or directly from your bank account is the easiest way. You won’t pay interest or fees, but you need to have enough saved up.

Credit Cards: If you don’t have cash, you can use a credit card. This is helpful for big repairs, but if you don’t pay it off quickly, interest can add up.

Loans: If you don’t have cash or a credit card, you can get a personal loan from a bank. This gives you more time to pay, but you will have to pay interest.

0% APR Credit Cards: Pay Over Time with No Interest

Some credit cards offer 0% APR for a certain period, like 12 to 18 months. This means you can pay for your car repair over time without paying any interest as long as you pay off the balance before the period ends.

Tips for using a 0% APR credit card:

Plan Your Payments: Make sure you can pay off the balance before the interest starts.

Use the Card Only for Repairs: Avoid adding new charges so you can manage your payments better.

Read the Fine Print: Some cards have fees, so be sure to understand the terms.

Local Banks and Credit Unions: A Good Option

Local banks and credit unions can offer personal loans with lower interest rates than credit cards. If you have a good relationship with your bank, you might get a loan with good terms.

Why choose a local bank or credit union?

Lower Interest Rates: These places often have better rates than big banks.

Flexible Terms: You might be able to get terms that fit your budget better.

Quick Approval: If your credit is good, you can get approved fast.

Avoid High-Interest Loans: Be Careful

Watch out for lenders that offer quick loans with high-interest rates. These loans can trap you in debt, making it hard to pay off your repair. Instead, look for safer options like a 0% APR credit card, a bank loan, or a payment plan through your repair shop.

Use Your Repair Savings for Insurance Deductibles

If you have been saving for car repairs, you can also use that money to pay your insurance deductible if needed. For example, if you have an accident and need to pay a deductible, your repair savings can cover that cost. This way, you won’t need to borrow money.

Start a Car Maintenance Budget Savings Plan

The best way to pay for car repairs is to save in advance. Set aside a little money each month. Over time, it will add up. When your car needs work, you will have the money ready. Even small savings can make a big difference.

Consider an Extended Warranty for Major Repairs

This section explains what an extended warranty is and how it can help with big car repairs.

It covers the benefits, like peace of mind and protection from expensive repairs, and the downsides, like the cost and limited coverage.

It also helps you decide if an extended warranty is right for you based on your car’s age, mileage, and how long you plan to keep it.

What Is an Extended Warranty?

An extended warranty is a plan you can buy to help cover major car repairs after your original warranty ends. It can protect your car maintenance budget from costly fixes like engine or transmission issues.

Why Get an Extended Warranty?

Peace of Mind: You won’t have to worry about paying for big repairs.

Helps with Expensive Repairs: It covers costly repairs, saving you money.

Adds Value to Your Car: If you sell your car, a warranty can make it more attractive to buyers.

Why You Might Not Need One

It Costs Money: You have to pay for the warranty, and it can be expensive.

Not Everything Is Covered: The warranty might not cover all repairs. You need to check what is included.

You Might Have to Pay a Deductible: Some warranties require you to pay part of the repair cost.

Is an Extended Warranty Right for You?

Think about these things:

New or Low-Mileage Cars: If your car is new or doesn’t have many miles, you might not need an extended warranty.

Older Cars: If your car is older, it might need more repairs, so a warranty could be helpful.

How Long You’ll Keep Your Car: If you plan to keep your car for many years, a warranty could save you money. But if you plan to sell soon, you might not need one.

How to Choose the Right Warranty

If you decide to get a warranty:

Read the Details: Make sure you understand what is covered.

Compare Plans: Look at different warranties to find the best one.

Check the Cost: Make sure the warranty is worth the price. Sometimes, it’s cheaper to pay for repairs yourself.

Using a Sinking Fund for

Auto Repairs and Insurance Deductibles

This section explains how to use a sinking fund to save money for both car repairs and your insurance deductible.

It covers what a sinking fund is, why it’s useful, and how to set one up.

The section also discusses when to use the fund for repairs or deductibles and the importance of continuing to save for future needs.

What Is a Sinking Fund?

A sinking fund is a special savings account where you set aside money regularly to cover specific future expenses. For car owners, it’s a smart way to prepare for both auto repairs and insurance deductibles. By adding a little bit of money each month, you can build up a fund that’s ready to cover these costs when they come up.

Why Use a Sinking Fund?

Using a sinking fund helps you stay financially prepared. It means that when your car needs repairs or you have to pay an insurance deductible, you won’t have to scramble for money or rely on credit cards. Instead, you’ll already have the funds set aside. This can give you peace of mind and help you avoid debt.

How to Set Up a Sinking Fund

Setting up a sinking fund is simple:

Set a Goal: Decide how much you want to save. Consider both your potential repair costs and your insurance deductible. For example, if your deductible is $500 and you want to save $1,000 for repairs, your goal would be $1,500.

Save Regularly: Break down your goal into manageable amounts. If your goal is $1,500, you might decide to save $125 each month for 12 months. Set this money aside in a separate savings account to keep it safe.

Stay Consistent: Make sure to add to your sinking fund every month. Even small contributions will add up over time.

When to Use Your Sinking Fund

You can use your sinking fund whenever you need to pay for car repairs or your insurance deductible:

For Repairs: If your car needs unexpected repairs, use your sinking fund to cover the cost. This way, you don’t have to dip into your emergency savings or use a credit card.

For Insurance Deductibles: If you get into an accident and need to pay your insurance deductible, your sinking fund can cover that too. This keeps you from having to come up with the money out of pocket.

Keep Your Sinking Fund Growing

After you use money from your sinking fund, start saving again. It’s important to keep adding to the fund so that you’re ready for the next repair or insurance expense. By continuously saving, you’ll always have a financial cushion for your car-related needs.

The Hidden Costs of Auto Repair and Maintenance

This section talks about the hidden costs of car repairs, like the time and hassle when your car is in the shop.

It also covers the cost of finding other ways to get around and the impact on your income if you miss work.

It gives tips on how to reduce these extra costs, such as planning ahead and arranging rides before your car needs repairs.

Time and Convenience: What You Might Lose

Car repairs and maintenance don’t just cost money; they can also take up your time. When your car’s in the shop, you might need to rearrange your schedule, adding stress to your day. Factoring in both time and your car maintenance budget helps you stay prepared, whether for daily commuting or unexpected repairs.

Alternative Transportation: How It Impacts Your Car Maintenance Budget

While your car is being repaired, you might need to pay for other ways to get around. Here are some options to consider:

Rideshare Services: Using apps like Uber or Lyft can be quick and easy, but costs can add up, especially if you need multiple rides.

Rental Cars: Renting a car gives you more freedom, but it can be expensive. Daily rental fees can range from $30 to $70, or more, depending on the car and location.

Public Transportation: Buses, trains, or subways can be more affordable. However, they might not always be convenient, depending on your location.

Budgeting for these costs ahead of time can help you avoid extra stress when your car needs repairs.

Lost Work Hours: The Impact on Your Income

If you need to take time off work to deal with car repairs, you might lose income. This is especially true if your job doesn’t offer paid time off. Missing even a few hours of work can affect your paycheck. Planning ahead and having a backup transportation plan can help you minimize lost work hours.

How to Minimize These Hidden Costs

Here are some tips to reduce the impact of these hidden costs:

Plan Ahead: If possible, schedule repairs during times when you don’t need your car as much, like on weekends or days off.

Arrange a Ride in Advance: If you know your car will be in the shop, set up rides with friends, family, or coworkers ahead of time.

Consider a Loaner Car: Some repair shops offer loaner cars while your vehicle is being fixed. Ask about this option when you book your appointment.

Being aware of these hidden costs and planning for them can help you manage your budget better when your car needs repairs.

What If You Can’t Afford Repairs or Maintenance?

This section gives tips on what to do if you can’t pay for car repairs.

It suggests carpooling, taking the bus, or using rideshare apps. It also talks about asking for payment plans at repair shops and finding help from charities.

The section says to focus on safety repairs first and start saving for future car costs.

Find Other Ways to Get Around

If you can’t afford to fix your car right now, here are some other options:

Carpool: Ask friends, family, or coworkers if you can share rides. It’s a good way to save money.

Public Transportation: Buses or trains might be cheaper than fixing your car. Check if there are options near you.

Rideshare: Use apps like Uber or Lyft for short trips. It’s more expensive than public transport but can be useful if you need a ride.

Ask for a Payment Plan

If you can’t pay for a repair all at once, ask the repair shop if you can pay in installments. Some shops may offer payment plans, so you can spread out the cost. It’s always good to ask if they can work with your budget.

Look for Financial Help

If you need help paying for repairs, there are places you can turn to:

Charities: Some local charities may offer help with car repairs, especially if you need your car for work.

Community Programs: Look for community grants or low-interest loans that can help with repairs.

Crowdfunding: You can try raising money through platforms like GoFundMe. Sometimes, friends and family, or even kind strangers, can help out.

Fix the Most Important Things First

If you can’t afford to fix everything, focus on what’s most important for safety:

Brakes: Make sure your brakes are in good shape.

Tires: Check that your tires are safe to drive on, and for more information on maintaining your vehicle’s performance, read our guide on how to check and replace wheel bearings.

Steering: Ensure your car steers properly.

Other repairs, like fixing dents or scratches, can wait until you have more money.

Maintaining your car not only saves you money but also enhances your safety on the road. Understanding the evolution of car safety features can help you appreciate how far automotive technology has come. For more information, check out our article on the evolution of car safety features.

Start Building Your Car Maintenance Budget for Future Repairs

To avoid this situation next time, start saving a little money each month for car repairs. Even small amounts can add up and help you be ready for the next repair. This way, you won’t have to worry as much when something needs fixing.

Beyond Budgeting:

Maximizing the Value of Your Car

This section explains how to keep your car’s value high.

It suggests doing regular maintenance, like oil changes and tire rotations. The section also helps you decide when to fix your car or when it’s time to get a new one. It also talks about how eco-friendly habits can save you money and make your car last longer.

Lastly, it reminds you to save money each month for future car needs.

Keep Your Car’s Value High with Regular Maintenance

Taking care of your car helps keep its value high. Simple things like regular oil changes, tire rotations, and brake checks make your car run better and last longer. When you’re ready to sell or trade in your car, having a well-maintained vehicle can get you a better price.

Decide When to Repair or Replace Your Car

Sometimes, it’s hard to decide whether to keep fixing your car or buy a new one. Here are some things to think about:

Cost of Repairs: If repairs are getting expensive, it might be time to think about replacing your car.

Age of the Car: Older cars might need more repairs. If your car is old and unreliable, a new car might be a better investment.

Reliability: If your car breaks down a lot, it might be worth getting a new one to avoid the hassle and cost of constant repairs.

Go Green and Save Money

Making your car more eco-friendly can also save you money:

Use Fuel-Efficient Tires: These tires can improve gas mileage and save you money on fuel.

Regular Maintenance: Keeping your engine tuned and tires properly inflated helps your car use less gas.

Drive Smart: Avoid hard braking and fast starts. This not only saves fuel but also reduces wear and tear on your car.

By taking these steps, you can help protect the environment and keep your car running longer.

Plan Your Car Maintenance Budget for the Future

Thinking ahead about your car’s needs can save you money and stress:

Set Aside Money for Maintenance: Even small savings each month can help you cover the cost of future repairs or maintenance.

Keep Records: Keep track of all the work done on your car. This can help you see patterns in repairs and make better decisions about when to fix or replace your car.

Conclusion

Recap of Budgeting Strategies

Budgeting for car repairs and maintenance is important. Set aside money each month for these costs. This way, you’ll be ready when your car needs work. Use a sinking fund or consider an extended warranty to help manage expenses.

Take Action Now

Taking care of your car before problems arise saves you money and stress. Regular maintenance prevents big repairs. Planning for these costs now means you won’t be caught off guard later. Start your budget today to keep your car in good shape.

Visit T Autocare Takedown

Our auto repair Broken Arrow shop is here to help with all your car needs. Whether it’s routine maintenance or big repairs, our team offers honest and reliable service. Come in for a free consultation, and let us help keep your car running smoothly.

Additional Reading Material:

- How much do you budget for auto maintenance? (Reddit.com)